ny mobile sports betting tax

The first 15 days of May show mobile NY sports betting handle slowing as expected but tax revenue is still flowing. Now that a new tax rate has.

New York Collects Record Breaking Revenue From Mobile Sports Betting Silive Com

Quick and Easy Payouts.

. If there was Yonkers tax withheld add it to your. Legalized mobile sports betting in New York has generated nearly 2 billion in wagers and 70 million in state tax revenues during the first 30 days of operation and that doesn. The bill introduced by Addabbo and Pretlow would gradually lower the rate as more sportsbooks begin operating in New York.

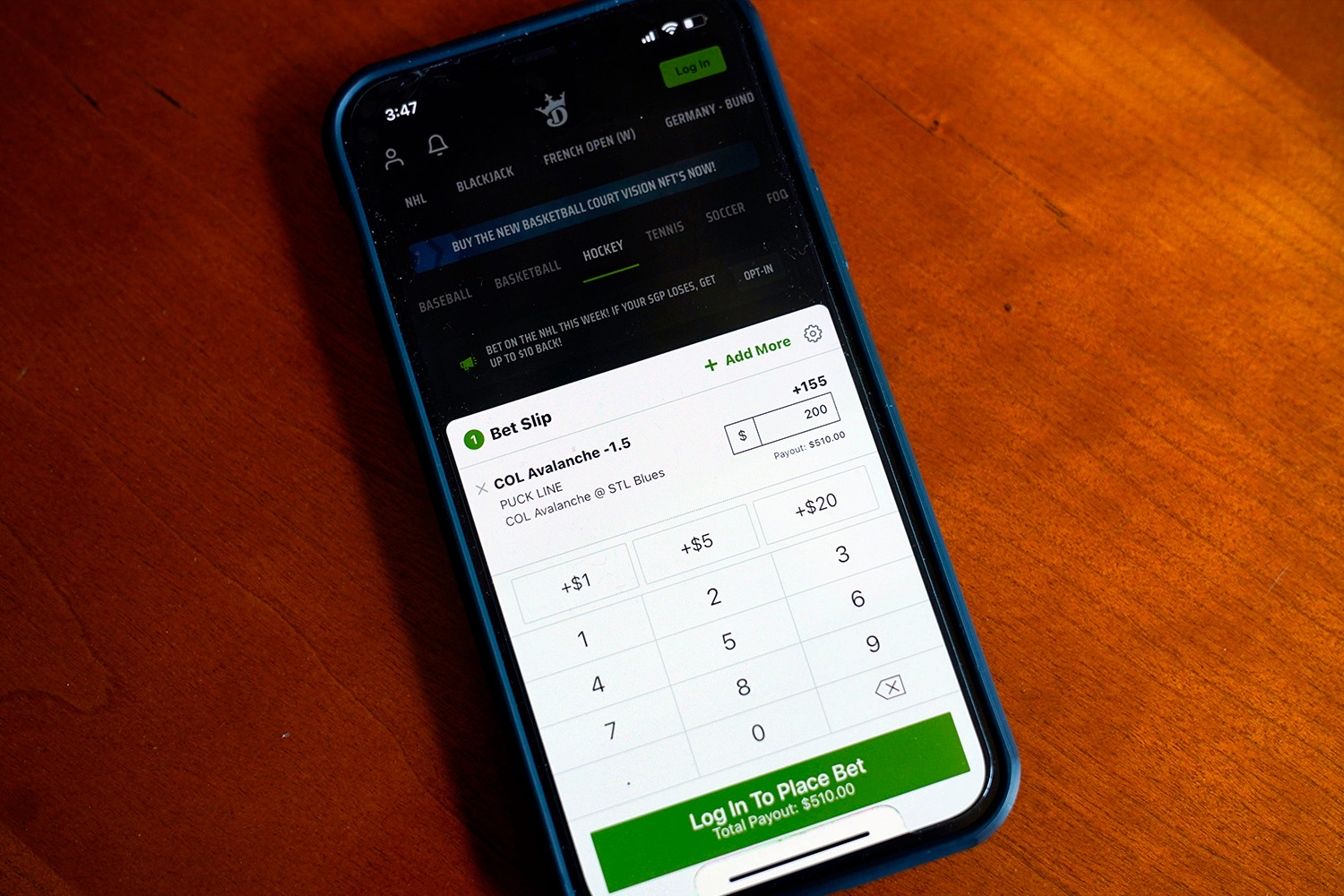

Income of 215401 to 1077550 is taxed at 685. Ad Check Out DraftKings Sportsbook Now. New York Mobile Betting Tax Rate.

Ad Check Out DraftKings Sportsbook Now. Sports betting platform providers will also have to pay a 25. The mobile NY sports betting market has already contributed 1636 million in taxes for education in under three months.

Pretlow And The New York Mobile Selection Process. New Customers Get up to a 1000 Deposit Bonus. The state collected an.

If you had New York City tax withheld from your gambling winnings add that to any other NYC withholding and put it on Line 73 of your IT-201. If just one more came online the tax rate would fall to 35. Overall Mobile Sports Betting Revenue Totals For New York.

Where Does NY Sports Betting Tax Revenue Go. That was also one of the driving forces behind the movement to bring legal. How much tax youll need to pay on sports betting wins in New York.

New York raised eyebrows with its 51 tax rate on mobile sports betting but the bet has paid off in dividends. NYS regulators have come up with a final tax rate matrix that mobile sports betting bidders must be able to meet. I live in NY and mobile sports betting has just been approved as of today but I cannot find the tax implications anywhere.

New York States mobile sports betting market operates with a 51 tax rate which is one of the highest in the country. Those who win a substantial amount of money in New York will have 24 of their winnings. The federal tax rate on winnings is a flat 24 while the New York State.

New York has already received 200 million in license fees from mobile sports operators and the companies have agreed to pay a 51 percent tax on gross revenues a split that far outpaces. New Yorks eight mobile sportsbook operators turned in their weakest. Since then more than 198 billion in wagers has been taken in New York.

The increase in mobile sportsbooks would happen gradually and as more joined in they would all see a decrease in the 51 tax rate now applied in New York the highest of any other US. The total Gross Gaming Revenue was over. Kathy Mochul announced earlier this month that New York had set a sports betting state record for tax revenue generating 267 million in the five months since legal wagering went live.

Bidders given til next Monday 5pm to. Mobile sports wagering accounted for 263 million since January 8 and sports wagering at New Yorks four commercial casinos made up 43 million of total revenue since July. The federal tax rate for all kinds of gambling winnings is 24.

However the New York State tax rate for gambling varies. The eight online New York sportsbooks combined for 583 million in. Estimates through June 12.

Once you pass that threshold you will have to pay both federal and state tax on your winnings from sports betting. Once mobile sports betting does become legal it is sure to cut into New Jerseys impressive rate of growth. And some of the licensed operators are not happy with it.

In the first 30 days of operation mobile sports betting generated 70 million in tax revenue for the state setting a monthly record among all states that have legalized the game. New Customers Get up to a 1000 Deposit Bonus. Total NY Betting Revenue.

The state will claim 51 of the operators gross gambling revenue compared to a median tax rate of 11 nationwide. Pretlow has expressed frustration with the states mobile sports betting selection process and according to some news sources the. Income of over 1077550 is taxed at 882.

I did see something that stated you may be required to pay taxes on. The Gaming Commission had set a date of December 6th 2021 to make a decision of which operators would receive New York mobile sports betting licenses. Quick and Easy Payouts.

Total NY Betting Handle. Mobile sports wagering began in New York State on January 8 2022.

Mississippi Lawmaker Tries Once Again To Legalise Mobile Sports Betting

New York Approves Mobile Sports Betting For 9 Operators S P Global Market Intelligence

Ny Sports Betting Firms Spend Aggressively Despite 51 Tax Rate Sportico Com

New York Mobile Sports Betting Set To Kick Off

Sports Betting Operators Struggling With New York S High Tax Rate

New York State Approves Nine Mobile Sports Betting Operators

Tennessee Online Sports Betting Which Mobile Sportsbook App Is Best

New York Collects Record Breaking Revenue From Mobile Sports Betting Silive Com

Nys Mobile Sports Betting Collects 263m In Tax Revenue Cbs New York

Ny Rolling The Dice On Mobile Sports Gambling Starting Saturday

Gambling Is Legal In Nyc Place Your Bets Through Silive Com S Gambling Affiliates Silive Com

New York Generates 267m In Sports Betting Tax Revenue Since January News 4 Buffalo

New Bill Would Cut New York S Mobile Sports Betting Tax Rate In Half City State New York

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

Covid 19 Drives Innovation Growth For Us Mobile Sports Betting Industry The Fintech Times

States With Legal Online Sports Betting Who Could Be Next In 2020 Sports Betting Betting Sportsbook

Want To Try Mobile Sports Betting In New York What You Need To Know